Payment reminder

Payment reminders are a way to communicate with the customer to get them to pay their debt. Not every unpaid invoice is a sign of a dishonest debtor.

A simple oversight can be the cause. Before resorting to more serious procedures, it is therefore necessary to try to contact the client concerned:

- Phone calls

- emails

- simple and registered mail

- SMS

Each company has its own dunning procedure and it should be defined. It should define the different payer profiles and how to dun them:

- The automatic payer, to whom you have made accept an automatic payment method. In this case the dunning is to be avoided.

- The good payer, whose check arrives on the due date or who returns the bill of exchange on the requested date: unnecessary reminder.

- The negligent payer, who always "scrapes" a few days, waits to be reminded, has misplaced the invoice, etc. Follow up very commercially, but quickly

- The bad payer, who has the means to pay you, knows the value of money and knows how to use it to his advantage: he wants to pay you as late as possible, or even never if you give him the opportunity. Beware of technical errors: he would take full advantage of them! Follow up quickly and firmly and resort to litigation without delay

- If the payer is insolvent, he cannot pay you, at least for the time being, if his cash flow difficulties are only temporary... Increase the pressure if it is a small amount; if not, quickly obtain a partial payment and try to set up an instalment plan

- The administrative payer, he always pays very slowly, because of the complexity of his circuits. Understand his circuits and build a good relationship with the people in charge of scheduling.

- The "dispute first" payer always invokes a dispute, whether proven or not, to delay payment of his debts, he never receives the first invoice and mentions disputes that are often minor but blocking. Anticipate with reminders before the due date, respond quickly to his requests by making him understand that you are not fooled and resort to litigation without delay

The internal reminder will be done mainly by phone because it allows :

- get in touch with the customer immediately

- immediately confirm that the message has been received and understood

- Establish two-way communication to resolve issues quickly

- change your approach during the phone conversation, if necessary

- to accentuate the urgency of the situation

- immediately determine the effectiveness of the communication since there is no need to wait for a deadline. To be effective, reminders must follow a few rules.

Analysis of the ageing balance

The aged balance, as its name indicates, represents the list of all "aged" invoices, i.e. those that have passed their due date. Its regular and methodical analysis allows a good management of the DSO (Days Sales Outstanding). As such, it is necessary to treat differently delays linked to cash flow problems, delays linked to disputes or delays linked to deficiencies in the company's internal collection processes.

The current "fashion" for justifying a late payment seems to be based on a more or less justified dispute (invoice not received, commercial promise, etc.). In this case, the company must protect itself upstream by setting up very rigorous commercial and contractual processes.

The law of pareto

The so-called "Paretto's law" shows that 20% of the customer portfolio generally represents 80% of the turnover. These customers are therefore vital to the company and must be given special attention:

- vigilance on clients belonging to the 20% of the client portfolio,

- Adaptation of the dunning schedule according to the customer's position.

An unpaid invoice in the 20% of the portfolio can have catastrophic consequences on the health of the company, given the difficulty of rebuilding the margin.

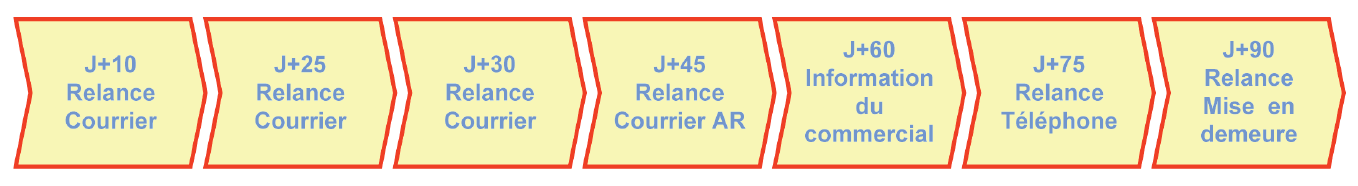

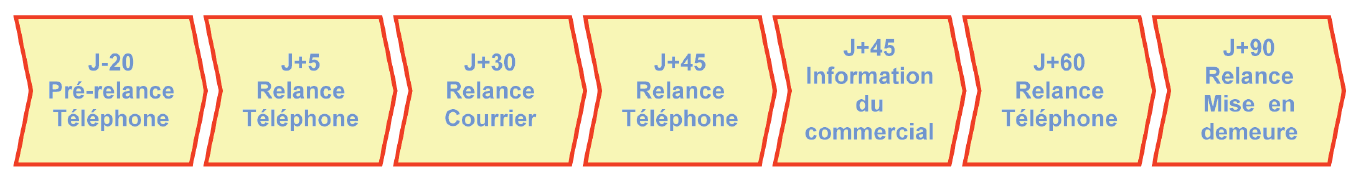

2 examples of recovery strategies, observed in the market:

Example 1: Periodic billing - Low volume of customers - Large invoice amount :

Example 2: Recurring billing - High volume of customers - Low invoice amount